As you may aware the parliament has passed the new penalty regime for Self-managed Superannuation Fund (SMSF). Under the new legislation, ATO will gain the power to issue on the spot fines, directly and personally, to SMSF trustees using a range of penalties to match the seriousness if an offence.

As you may aware the parliament has passed the new penalty regime for Self-managed Superannuation Fund (SMSF). Under the new legislation, ATO will gain the power to issue on the spot fines, directly and personally, to SMSF trustees using a range of penalties to match the seriousness if an offence.

The new regime also increases the penalty unit from $110 to $170, or increased by 55%. ATO has indicated that each reported offence will automatically generate a penalty notice on each trustee.

This will put individual trustees to a disadvantage situation compare to a corporate trustee, as each trustee will bear the fines individually.

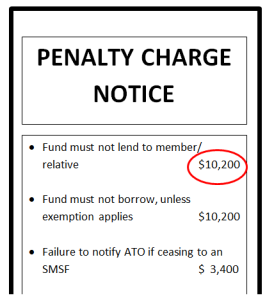

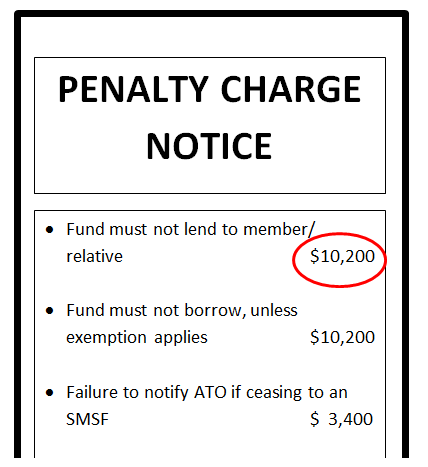

For example, a contravention report is reported to ATO due to lending money to a member or a relative (a serious breach of section 65(1)). This will attract a fine of 60 penalty points, or $10,200 (60 x $170).

If the trustee is a corporate trustee, then only the company will get the fine of $10,200. On the other hand, if the fund is individual trustees with 3 members, then each member may get a fine of $10,200, or a total fine of $30,600.

Trustee(s) may apply to waive the fines. ATO may waive or reduce the penalty based on past history and seriousness of breach. ATO also may order the trustee(s) to:

• Rectification direction (sec. 159) – a written order by ATO to trustees to correct their wrong-doing within specified time period. For example, ATO may direct trustees to sell their property (if they were not prepared to this voluntarily).

• Education direction (sec. 160) – a written order to trustees to attend a specified course of education within a specified time period.

Below is some penalty guidance that may be imposed by ATO:

| Section | Description | Penalty Units | Penalty of each trustee |

| 160(4) | Failure to comply with Tax Office education direction | 5 | $850.00 |

| 124(1) | Failure to appoint an investment manager in writing when one is appointed | 5 | $850.00 |

| 254(1) | Failure to provide information to regulator on approved form | 5 | $850.00 |

| 347A(5) | Failure to complete a form with requested information as part of ATO’s survey | 5 | $850.00 |

| 35B | Failure to prepare financial statements | 10 | $1,700.00 |

| 103(1) & (2) | Failure to keep trustee minutes for at least 10 years | 10 | $1,700.00 |

| 104 (1) | Failure to keep records of change of trustees for at least 10 years | 10 | $1,700.00 |

| 34 (1) | Failure to follow prescribed standards | 20 | $3,400.00 |

| 106A(1) | Written notice to ATO if ceasing to be an SMSF | 20 | $3,400.00 |

| 65(1) | Fund must not lend to member/relative | 60 | $10,200.00 |

| 67(1) | Fund must not borrow, unless exemption applies | 60 | $10,200.00 |

| 84(1) | Fund must not breach in-house asset rules | 60 | $10,200.00 |

| 106(1) | Failure to notify ATO of significant adverse events immediately | 60 | $10,200.00 |

Comments are closed