This article provides information about how the Tax Office impose record keeping penalties on a tax payer. It is tax payers’ duties to keep all relevant tax records in English or in a form readily accessible and easily convertible into English. Records can be kept in any way that enables tax payers to meet their tax obligations and receive entitlements, whether this is on paper or in electronic form.

The Tax Office may impose record keeping penalties to you for not keeping proper records of your business activities.

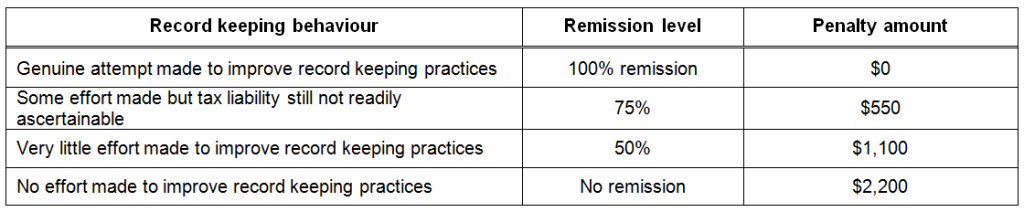

The tax law imposes a penalty if proper records are not kept. The penalty amount is currently $2,200. Penalties may be remitted (partially or fully) if companies are trying to do the right thing. However, if no attempt is made to keep records or they are deliberately destroyed, companies will be unlikely to receive any remission of the penalty.

If proper records are not kept, even after the Tax Office has provided advice about record keeping and given the company an opportunity to improve their record keeping behaviour, the Tax Office will apply the record keeping penalties as set out as followed:

Serious cases of non-compliance can be referred to the Director of Public Prosecution which may result in a fine of up to $10,000.

Therefore it is important to maintain a good record keeping in in order to avoid the record keeping penalties. Feel free to contact us to help you to sort out this issue.