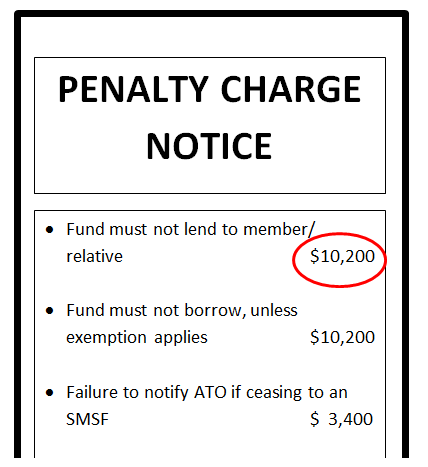

‘On the spot Fine’ is on The Way

As you may aware the parliament has passed the new penalty regime for Self-managed Superannuation Fund (SMSF).[…]

Managing Your SMSF

One of trustee key responsibilities is managing your fund’s investments. The investment decisions should be designed to[…]

Setting up An SMSF

Your SMSF needs to be set up correctly so that it’s eligible for tax concessions, can pay[…]

SMSF – Advantages & Disadvantages

An SMSF can become a powerful vehicle for your retirement. We include some advantages and disadvantages of[…]